Free ARV and MAO Calculator: Get Your Numbers Fast!

Looking for a quick way to estimate your After Repair Value (ARV) and Maximum Allowable Offer (MAO)? Our free ARV and MAO calculator is the perfect tool to get you started! Whether you’re a real estate investor, wholesaler, or just curious about potential deals, this calculator provides a rapid assessment of your numbers.

While our free tool offers a great initial estimate, for a truly comprehensive analysis and to “dial in” your real estate numbers, we highly recommend Rehab Valuator It’s our top pick for a reason!

Why Choose Rehab Valuator for In-Depth Analysis?

Rehab Valuator is a complete software solution designed to 10x your real estate business. It goes far beyond a basic ARV and MAO calculation, offering features essential for any real estate professional, including:

Accurate Real Estate Comps: Quickly find comparable properties to ensure your ARV is precise.

Owner and Mortgage Information: Gain valuable insights into property ownership and existing liens.

Advanced MAO Calculation: Go beyond simple formulas to determine your true maximum allowable offer, considering all deal specifics.

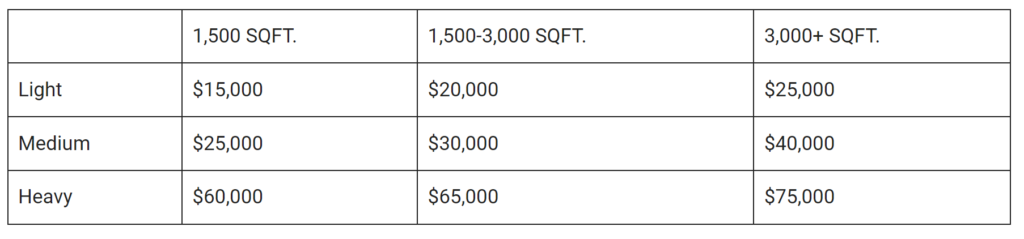

Detailed Rehab Cost Insights: Understand potential renovation expenses to accurately assess profitability.

No matter if you’re a wholesaler, an end buyer, a builder, or any other real estate professional, Rehab Valuator provides the in-depth data you need to confidently decide if a property is a “deal or no deal.”

Ready to get a quick estimate? Use our free ARV and MAO calculator below! For a more powerful analysis that can transform your business, explore the capabilities of Rehab Valuator.

Wholesalers: Stop Overpaying for Deals!

Are you a real estate wholesaler consistently paying 80-82% of ARV for your deals? While it’s great if you have a robust buyer list that can profit at those numbers, this should be the exception, not the rule. We hear daily from investors who are tightening their buying criteria. They’re actively looking for deals around 70-75% of ARV (all in), and those deals get snapped up fast!

This means you need to crunch your numbers thoroughly before you even pick up the phone to call a motivated seller. It might take a little more time upfront, but the payout will absolutely be worth it.

Understanding the 70% Rule (and Why It’s Crucial)

The 70% rule is a fundamental calculation in real estate investing that helps you quickly determine the maximum price you should offer on a property. Here’s how it works:

ARV (After Repair Value)×0.70−Repairs=Maximum Offer

This formula provides a 30% margin to cover your profit, holding costs, and closing costs. Many experienced investors even tighten this number further, aiming for a 75% rule to ensure even stronger margins.

By understanding and applying the 70% (or 75%) rule, you’ll be able to present offers that are attractive to serious investors and increase your chances of moving deals quickly and profitably.

Ready to get started in real estate investing? Wish you had a team of mentors to guide you?